The wonderful thing about investing is that no matter what happens in the world, you can have faith in one immutable fact, people want to make money. There is a strong disposition in human beings to be continually unsatisfied. We strive for perpetual improvement in a myriad of ways. One example, is by accumulating and passing on wealth. It is a survival instinct for humans to never be too comfortable nor too content.

We are now in July of 2020. Globally, the pandemic is being dealt with and the markets are recovering. Likewise, businesses are operating again and the unemployment rates have been steadily dropping. Meanwhile, investment returns are looking great for those who stayed the course, continued investing consistently and did not give into panic.

We can assume that this trend will continue with confidence and 2020 will end as a positive year. This is my opinion and optimistic outlook. Only time will reveal the truth.

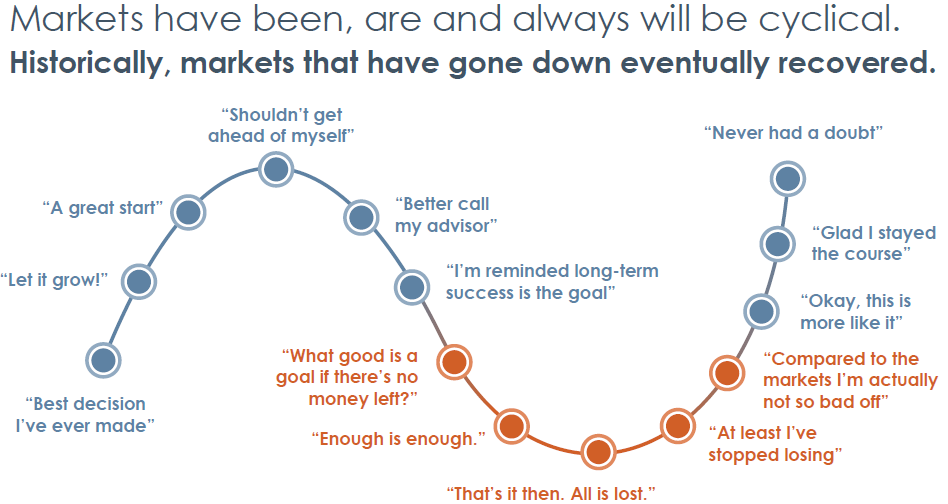

Human beings have a predilection towards the negative. That’s okay, it is a survival mechanism, to keep us on our toes. As a result, we sometimes allow negativity to define our reality. This reality must be challenged.

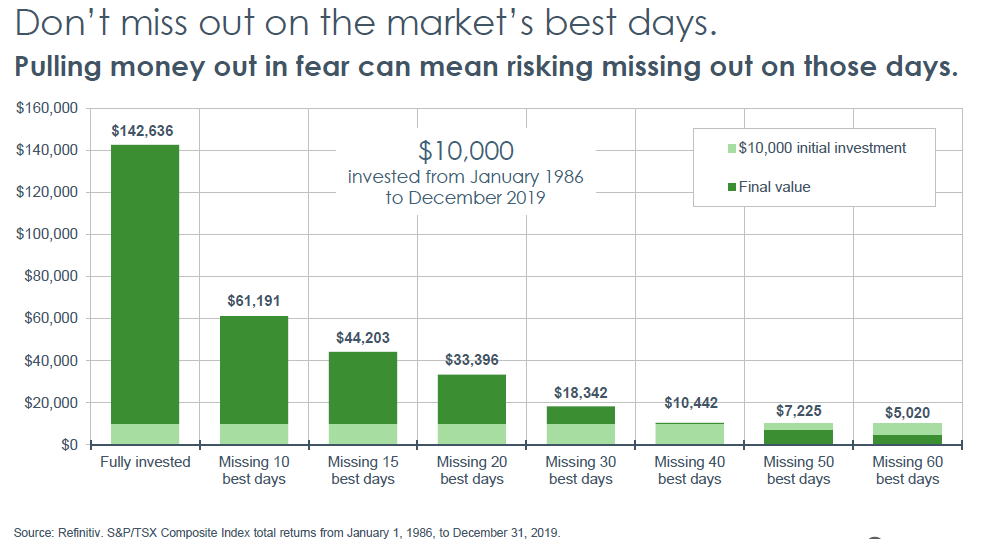

The cause of volatility in the market doesn’t matter, an investor’s behavior dictates the end result. Consistency and discipline trumps panic and market timing. See the charts below. The positive moments outweigh the negative ones over the long run. Therefore, it is far more reasonable and probable to expect a positive return over time than focus on the small number of negatives.